Pre-Authorisation Functionality

About Pre-Authorisation

Not everyone will need or want to process Pre-authorisation payments. They are used when you want assurances around a Cardholder's ability to pay for goods, without knowing what the final value of those goods are. Some key places where you will see this are:

- Fuel Pumps - the card is Authorised for £99 and debited for the actual value of the fuel that is pumped

- Car Hire - the card is Authorised for a deposit amount e.g. £250 and this is returned to you when the vehicle is returned

- Hotels - the card is Authorised for a fixed amount, allowing you to charge items and services to your room. The final amount is debited after you check out.

Please speak to your Account or Business Development Manager if you want to use Pre-Authorisation. This needs to be applied for and configured specifically for each account.

Pre-authorisation Functionality is only available to Merchants using DNA Payments as their Acquirer. Please contact us if you would like to discuss changing your Acquirer to DNA.

Not all Cards are able to process Pre-Authorisation.

In addition, some Card Issuers will hold Pre-Authorised funds for several weeks after Completion or Reversal. This is beyond our control. Our Pre-Authorisation solution is certified as compliant by Mastercard and Visa.

Cardholders should be referred to their Card Issuer if fund reservation persists on their account despite your terminal not showing any outstanding Pre-authorisation for them.

Pre-Authorisation involves 5 key steps:

- Authorising an initial charge amount

- Looking up current Authorised amounts

- Topping up that original amount with a larger amount

- Completing the final amount (whether larger or smaller than the original amount)

- Cancelling the initial original amount.

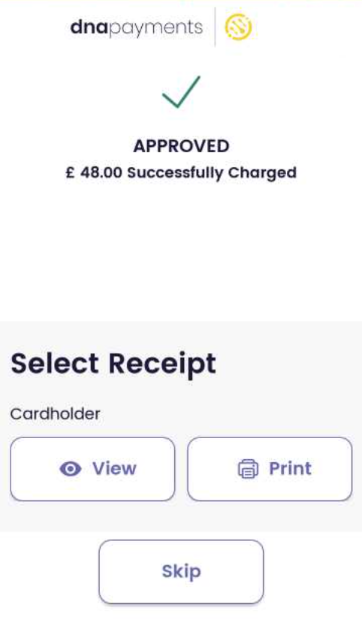

Initial Authorisation

This is completed in a similar way to Refunds or other non-Sales amounts, as below.

| Step | Instruction | Guidance Image |

|---|---|---|

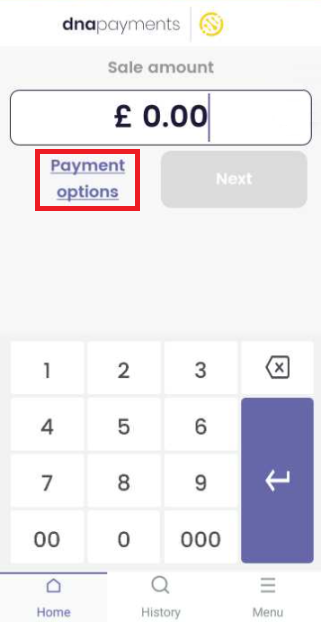

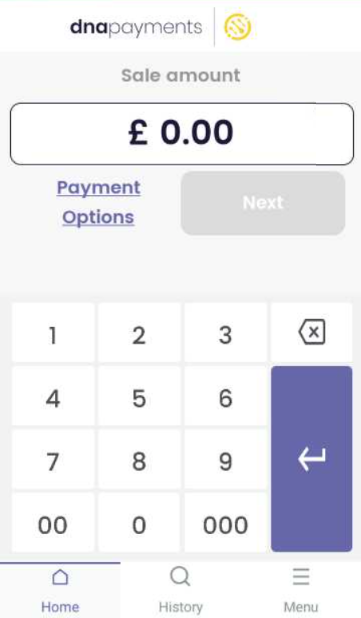

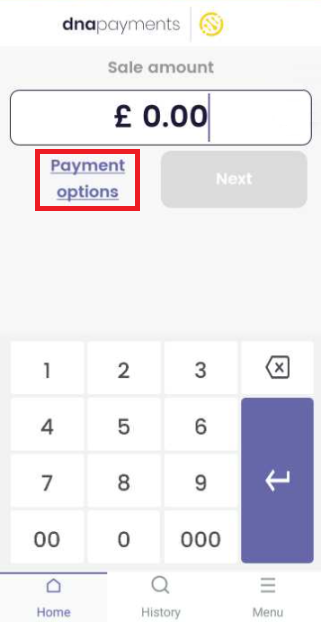

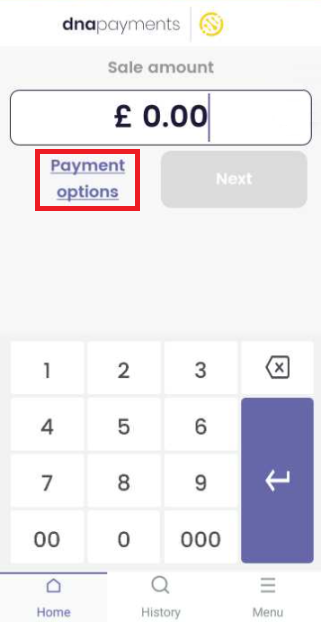

| 1. | To start a pre-authorisation, press the 'Payment Options' button highlighted. |  |

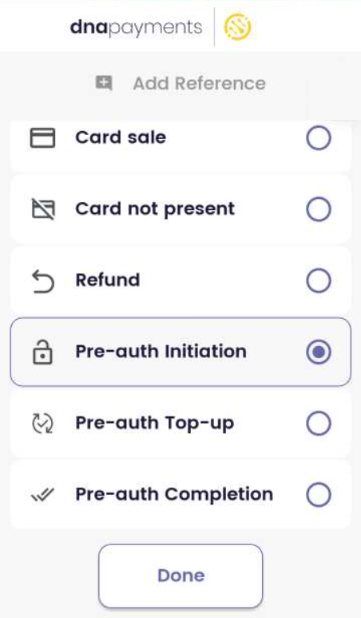

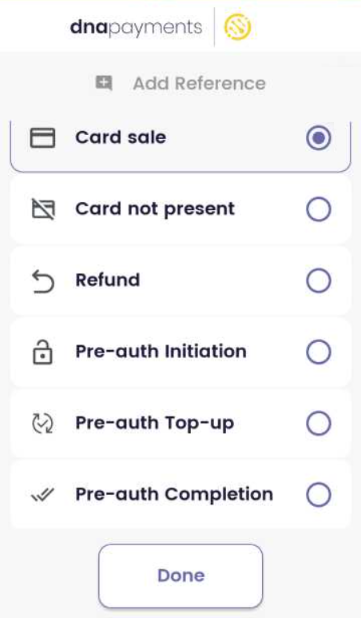

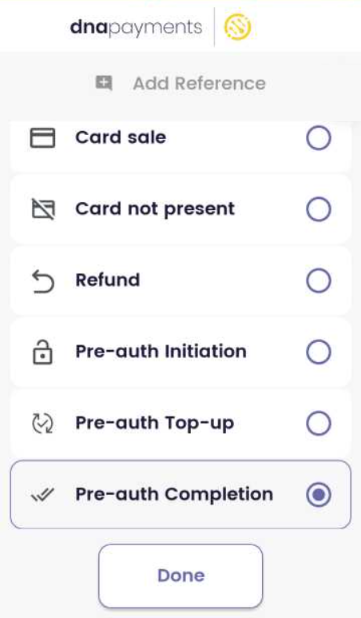

| 2. | Select 'Pre-auth Initiation' from the options shown and press 'Done'. |  |

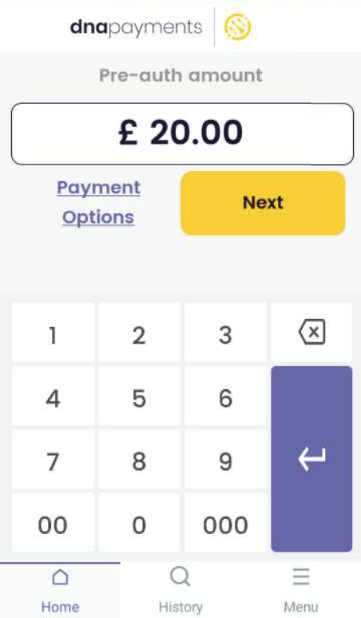

| 3. | Enter the amount to Pre-Authorise. |  |

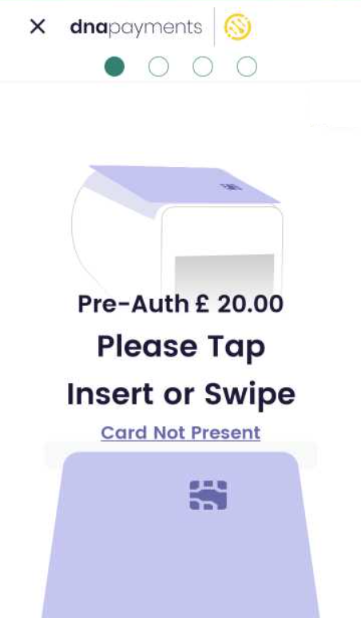

| 4. | Present the card. |  |

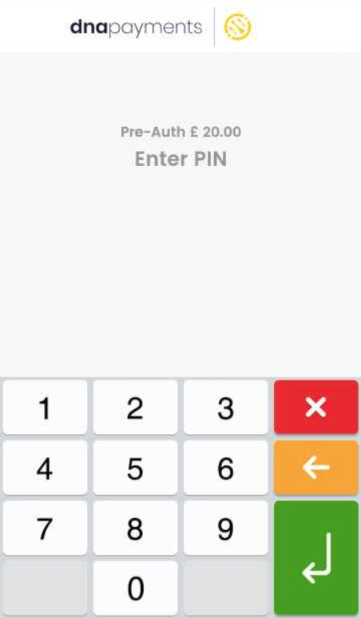

| 5. | If required, enter the PIN number. |  |

| 6. | The Pre-authorisation will be authorised with the cardholder's card issuer. |  |

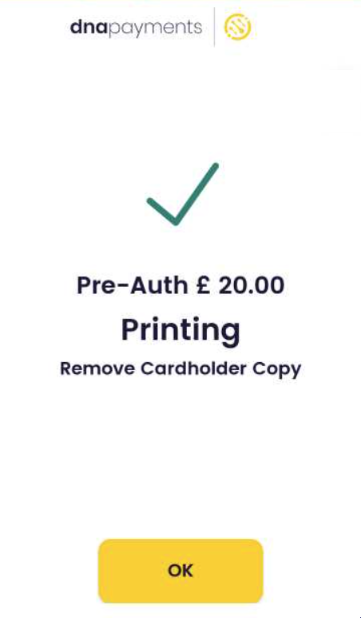

| 7. | axept® PRO will then print the cardholder and merchant receipts, if configured to print them. |  |

| 8. | axept® PRO will then return to the default 'Sale' screen when completed. |  |

Pre-authorisation Initiation is now complete.

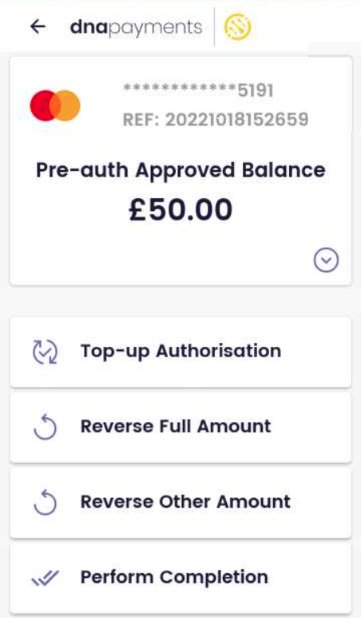

Looking up an existing Pre-Authorisation

Topping up, or completing, an existing Pre-authorisation can be done in two ways. You can start the transaction using the 'Payment Options' menu and enter the Pre-Authorisation value either manually or by re-presenting the original payment card. These will be shown in the Topping Up and Completing sections later on. You can also access it as shown in this section.

Looking Up a Pre-Authorisation is required when Cancelling a Pre-Authorisation

| Step | Instruction | Guidance Image |

|---|---|---|

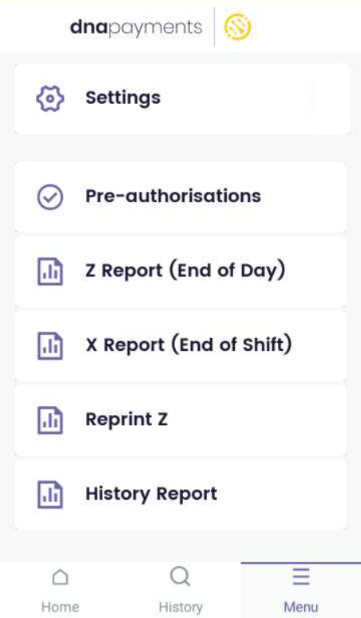

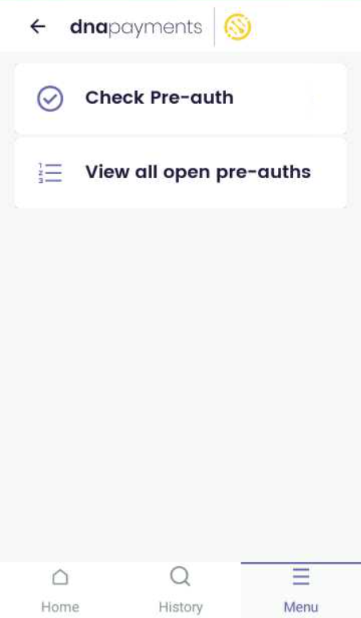

| 1. | Press the 'Menu' button in the bottom right of the screen and select 'Pre-authorisations'. |  |

| 2. | You can check a specific pre-auth, but we are going to 'View all open pre-auths'. |  |

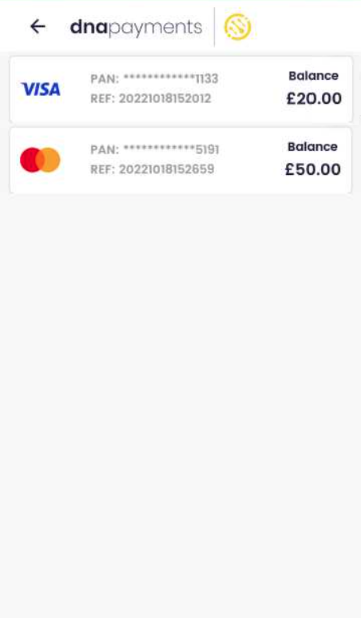

| 3. | All open Pre-auths are displayed with the amount, the reference number, and the starred PAN of the card. |  |

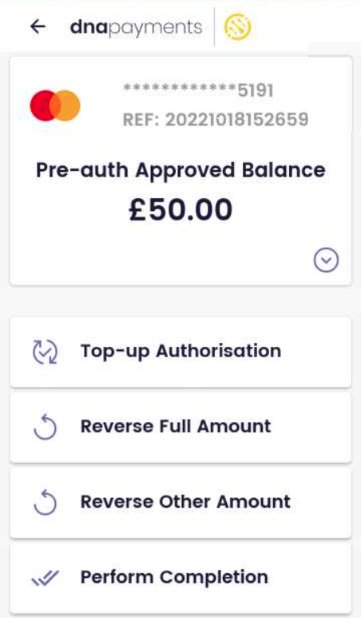

| 4. | From here, you can view the pre-authorisation and either: Top-Up Reverse Fully or Partially, or Complete. These options will be detailed later. |  |

Topping Up

You will use Top Up only when you want to add value to the existing Pre-Authorisation, but are not yet ready to finalise the bill.

Example

A Hotel guest pre-authorised for £100, but has charged drinks and food to their room totalling £200 over the first 3 days of their 5-day stay. The Hotel might Top Up the original amount to a new value of £500, to reduce the risk they are exposed to.

To start a Top Up, you can either navigate to the existing Pre-authorisation as shown in the above section or follow the steps below. If you have navigated directly, please skip to Step 3. Step 4 will be missed in this flow.

| Step | Instruction | Guidance Image |

|---|---|---|

| 1. | To start a Top-up, press the 'Payment Options' button highlighted. |  |

| 2. | Select 'Pre-auth Top-up' and press 'Done'. |  |

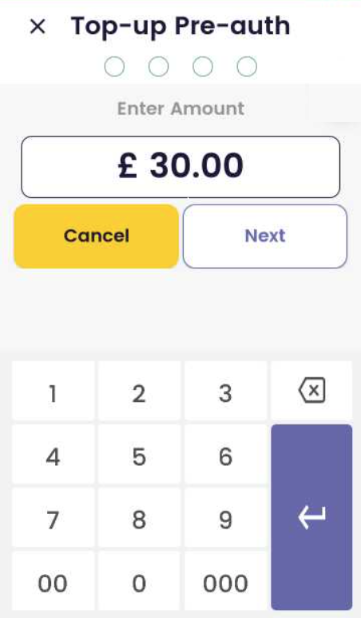

| 3. | Enter the amount you want to top up. This is an incremental amount, not a new total e.g. £50 + £30. |  |

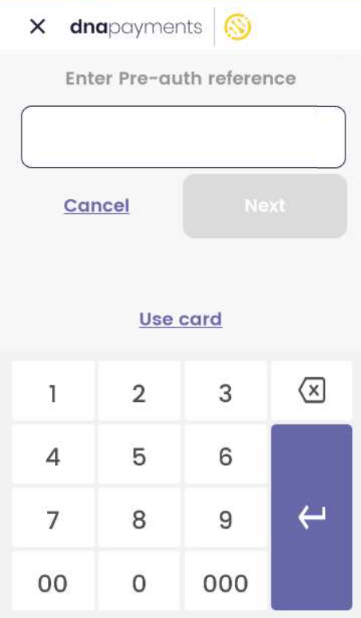

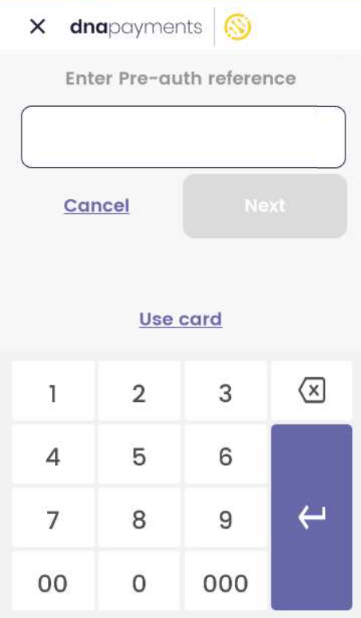

| 4. | If prompted, enter the original Pre-Auth reference from the receipt, or select use card and re-present the card. In this case, it is not likely you will have the cardholder nearby. |  |

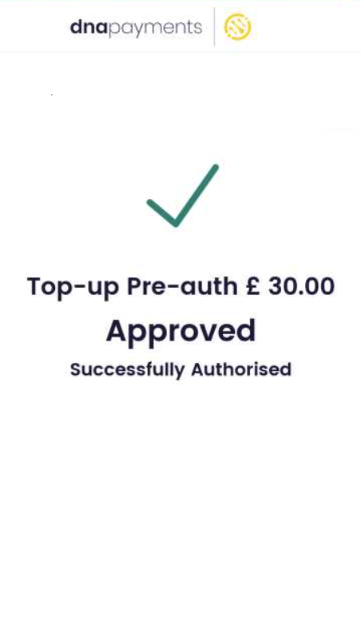

| 5. | axept® PRO will then attempt to authorise the top up. If successful, further receipts will be printed and the amount pre-authorised will be updated. |  |

Pre-Auth Completion

This function is used when the final amount is known and the funds are to be settled to the merchant's account.

The final amount can be higher than the original authorisation, however it is not guaranteed to be successful above the original amount. When this happens, axept® PRO attempts an incremental authorisation using the original card details. If this is successful, then the full amount is charged. If this is unsuccessful, only the original amount is successfully settled.

The additional balance of funds are lost in the case of a declined incremental authorisation. Only the original pre-authorised amount will be settled to you.

The original amount authorised should therefore be close to the expected charge amount, to reduce the your exposure to risk when Completing.

To start a Completion, you can either navigate to the existing Pre-authorisation as shown in the above section or follow the steps below. If you have navigated directly, please skip to Step 3. Step 4 will be missed in this flow.

| Step | Instruction | Guidance Image |

|---|---|---|

| 1. | To start a Completion, press the 'Payment Options' button highlighted. |  |

| 2. | Select 'Perform Completion' and press 'Done'. |  |

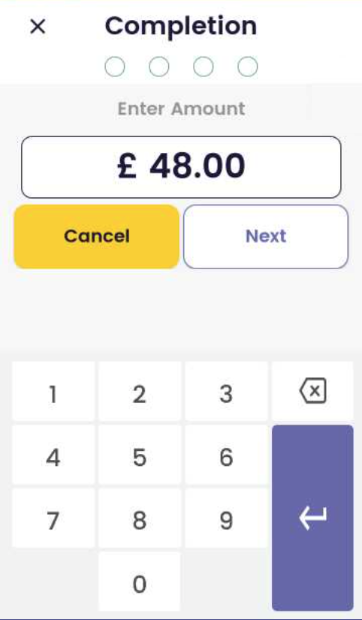

| 3. | Enter the amount you want to Complete. This should be the Final Total. |  |

| 4. | If prompted, enter the original Pre-Auth reference from the receipt, or select use card and re-present the card. The Completion attempts Authorisation. |  |

| 5. | When Completion is finalised, the authorised amount will be confirmed. |  |

| 6. | Any receipts will print. Any variation from the requested amount will be detailed on the receipt. |  |

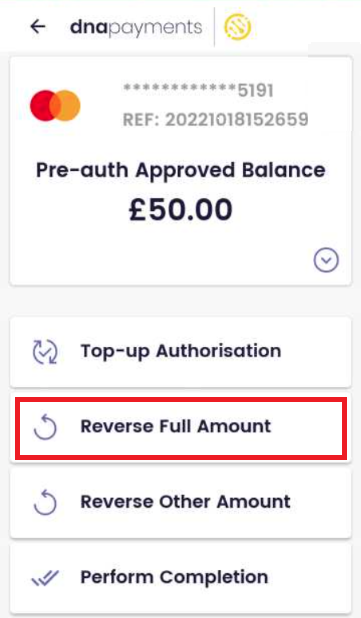

Cancelling Original Amount

You will use Cancellation only when you want to free up the Authorised funds on the cardholders card, typically when ZERO funds are required.

Examples

A Hotel guest pre-authorised for £100, but upon check out there were no room charges due. Following room servicing, the original £100 that was pre-authorised was Cancelled.

A customer returns a hire car and it is verified to be damage free. After inspection, the original £250 that was pre-authorised is Cancelled.

To start a Cancellation, you must navigate to the existing Pre-authorisation as shown in the above section. The below flow starts once you've looked up the specific transaction.

| Step | Instruction | Guidance Image |

|---|---|---|

| 1. | Look up the Pre-authorisation you wish to cancel. |  |

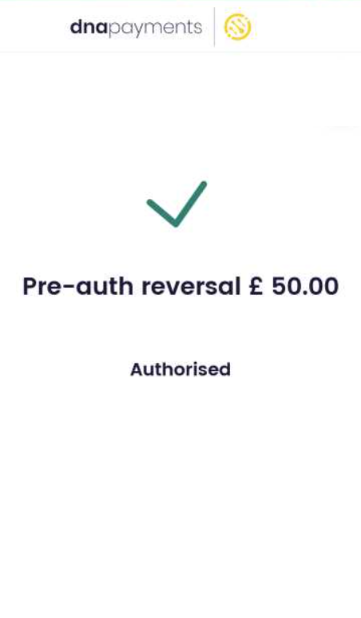

| 2. | Select 'Reverse Full Amount' and press 'Done'. |  |

| 3. | axept® PRO will go online to confirm the Full Reversal. The pre-authorisation is now cancelled |  |

Partial Reversal

You can perform a Partial Reversal (Reverse Other Amount) in Step 2 above, but this is rare. It is effectively the opposite of a Top-up, and will reduce the pre-authorisation value by the amount specified. You do not need to perform Partial Reversal following Completion; This is done automatically by axept® PRO.

Example Partial Reversal

The Hotel guest from before had pre-authorised for £100, but has charged drinks and food to their room totalling £200 over the first 3 days of their 5-day stay. The Hotel decided to Top Up the original amount to a new value of £500, to reduce the risk they were exposed to.

The guest however has complained about this, and after discussion with Hotel Management, the Hotel have agreed to reduce the value of the Pre-authorisation down to £300.

A Partial Reversal of £200 is completed, resulting in a current value of £300 pre-authorised.