Payment Request

Overview

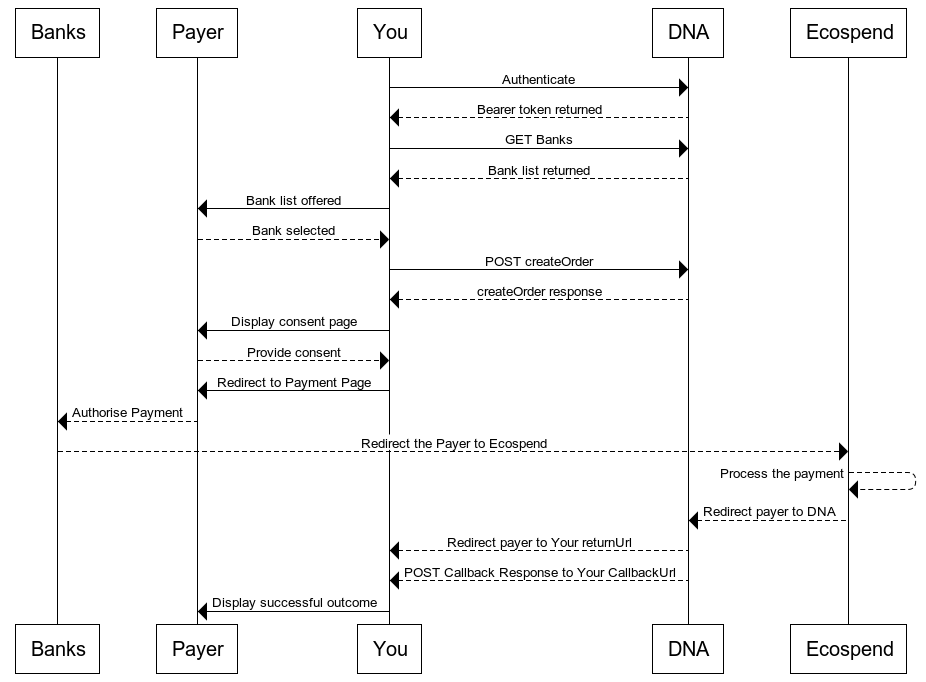

Once you have authenticated, you are able to send further requests in to the API. You will need to:

- GET Banks - use the API to return a list of banks available at this time.

- Offer Bank List - provide the bank list to the Payer and allow them to choose their bank.

- POST createOrder - confirm the bank and other transaction specific details.

- Display consent page - a mandatory step fo Open Banking. Can be combined with step 2.

- Redirect the payer - send the Payer to the provided bankURL.

- Display successful outcome - following a successful payment, ensure the payer is advised.

There are additional steps in the payer process which are completed securely outside of your website. This reduces your PCI compliance liability and provides peace of mind for the buyer.

GET Banks

Request

Test URL: https://test-api.dnapayments.com/v1/ecospend/banks

Production URL: https://api.dnapayments.com/v1/ecospend/banks

The request is completed via a GET request to the test URL shown above, and should contain the below header data. The access_token will be the one received in the Authentication Response.

| HTTP Header | |||

|---|---|---|---|

| Field Name | State | Data Type | Description |

| Content-Type | Mandatory | String | application/json |

| Authorization | Mandatory | String | Bearer access_token |

Example

GET https://test-api.dnapayments.com/v1/ecospend/banks

HTTP/1.1

Content-Type: application/json

Authorization: Bearer 6945595921271780

User-Agent: PostmanRuntime/7.26.8

Accept: */*

Host: 192.168.0.75:8080

Accept-Encoding: gzip, deflate, br

Connection: keep-alive

Response

If the request is successful, the method will return a 200 response code. All your merchants will be returned as an array containing the following fields:

| GET Banks | ||

|---|---|---|

| Field Name | Data Type | Description |

| data | Array | An array of objects for each bank available. See the data array for more information. |

| meta | Object | Meta data for the entire response. See the meta Object for more details. |

data Array

| data Array | |||||

|---|---|---|---|---|---|

| Field Name | Data Type | Description | |||

| bank_id | String | The unique bank ID, derived from the EcoSpend system. | |||

| name | String | The name of the bank. | |||

| friendly_name | String | The friendly name of the bank. | |||

| is_sandbox | String | Indicates if the record returned is in a sandbox (test) bank environment. | |||

| logo | String | The logo URL of the bank. | |||

| icon | String | The icon url of the bank. | |||

| standard | String | Which open banking standard is implemented by the bank. Available options are:

| |||

| country_iso_code | String | The country code that the bank operates in. | |||

| division | String | The division of the bank e.g. Available options are:

| |||

| group | String | The group where applicable of the bank e.g Barclays. | |||

| order | String | The preference of the bank. Can be amended to show a given bank before another. | |||

| service_status | Boolean | Indicates if the bank's services are online currently. | |||

| refund_supported | Boolean | Indicates if the bank's services are online currently. | |||

| abilities | Object | The operations supported by the specific bank. See the abilities Object for more information | |||

abilities Object

| meta Object | ||

|---|---|---|

| Field Name | Data Type | Description |

| domestic_payment | Boolean | true if the bank supports Domestic Payments. |

| domestic_scheduled_payment | Boolean | true if the bank supports Domestic Scheduked Payments. |

| domestic_standing_order | Boolean | true if the bank supports Domestic Standing Orders. |

| domestic_standing_order_installment | Boolean | true if the bank supports Domestic Standing Order Installments. |

| domestic_standing_order_yearly_period | Boolean | true if the bank supports yearly intervals for Domestic Standing Order Payments. |

| international_payment | Boolean | true if the bank supports International Payments. |

| international_scheduled_payment | Boolean | true if the bank supports International Scheduled Payments. |

| international_standing_order | Boolean | true if the bank supports International Standing Orders. |

| bulk_payments | Boolean | true if the bank supports Bulk Payments. |

meta Object

| meta Object | ||

|---|---|---|

| Field Name | Data Type | Description |

| total_count | Integer | The total number of Banks returned. |

| total_pages | Integer | The total number of pages. |

| current_page | Integer | Current page. |

Example

{

"data": [

{

"bank_id": "obie-coutts-sandbox",

"name": "Barclays Personal",

"friendly_name": "Coutts Online Banking Test",

"is_sandbox": true,

"logo": "https://{uri}",

"icon": "https://{uri}",

"standard": "obie",

"country_iso_code": "GB",

"division": "Personal",

"group": "CMA9",

"order": 0,

"service_status": true,

"refund_supported": false,

"abilities": {

"domestic_payment": true,

"domestic_scheduled_payment": true,

"domestic_standing_order": true,

"domestic_standing_order_installment": true,

"domestic_standing_order_yearly_period": true,

"international_payment": true,

"international_scheduled_payment": true,

"international_standing_order": true,

"bulk_payments": true

}

}

],

"meta": {

"total_count": 0,

"total_pages": 0,

"current_page": 0

}

}

Regardless of the various abilities offered by the Banks, the DNA Open Banking API supports domestic_payment only.

Offer Bank List

Having identified the banks, you should present these to the Payer within your own solution. We recommend using the supplied icon and logo URL's to provide payer confidence.

Once the bank has been selected by the Payer, you are ready to initiate the payment request.

POST createOrder

Request

The request is completed by a POST to the above URL's with these headers:

| HTTP Header | |||

|---|---|---|---|

| Field Name | State | Data Type | Description |

| Content-Type | Mandatory | String | application/json |

| Authorization | Mandatory | String | Bearer access_token |

And the createOrder payload as shown here:

| POST createOrder | |||

|---|---|---|---|

| Field Name | Data Type | State | Description |

| bankId | String | Mandatory | Unique identification String |

| amount | Decimal | Mandatory | Total amount of the order a GBP account will be proThis value must match t the request will be reject |

| currency | String | Mandatory | Currency of the transactioThis value must match t the request will be reject |

| invoiceId | String | Mandatory | Order/invoice/transaction/ for this transaction.This value must match t the request will be reject |

| description | String | Optional | Message from host website to consumer, displayed on the payment form and merchant portal. |

| accountId | String | Optional | Buyer’s account reference for the store processing the transaction. |

| String | Optional | Email address provided by consumer as main contact address. | |

| locale | String | Optional | Consumer language - used by DNA Payments Checkout to build the payment form eng |

| terminalId | String | Mandatory | Provided to the integrator following the successful creation of a merchant account. This value must match the value provided during authorisation if unique tokens are used or the request will be rejected. |

| paymentMethod | String | Mandatory | Payment method ecospend |

| transactionType | String | Mandatory | SALE |

| returnUrl | String | Optional | Address where the consumer is to be returned following a successful payment. |

| callbackUrl | String | Optional | Confirms where DNA Payments is to send the payment/refund notification (payment/refund result callback) in the event of a successful result. |

| failureCallbackUrl | String | Optional | Confirms where DNA Payments is to send the payment/refund notification (payment/refund result callback) in the event of an unsuccessful result. |

| billingAddress | Object | Mandatory | An object containing several mandatory and optional billing address fields. See billingAddress for more details. |

billingAddress

| billingAddress | |||

|---|---|---|---|

| Field Name | Data Type | State | Description |

| firstName | String | Mandatory | First name of the addressee. If the Merchant does not hold the title and last name separately, the full name is provided here and title, last name and middle names are left bank. |

| lastName | String | Optional | Last name of addressee. |

| streetAddress1 | String | Mandatory | Address Line 1 consumer resides in. |

| postalCode | String | Optional | Post code for consumer’s given address. |

| city | String | Mandatory | City consumer resides in. |

| country | String | Mandatory | Country consumer resides in. ISO 3166-1 (2 or 3 Char.) |

Response

If successful, this method returns a 200 OK Response.

| createOrder Response | ||

|---|---|---|

| Field Name | Data Type | Description |

| accountId | String | Unique reference for the store processing the transaction, as passed in the request. |

| amount | Decimal | Total amount of the order including decimal places where applicable. ‘Whole’ amounts (e.g. “1”) on a GBP account represents £1.00. |

| authDateTimeUtc | String | Date and time of when the transaction was authorised with the acquirer. |

| bankUrl | String | A unique and one time use only URL of the debtor's banking system. You will need to redirect a merchant to this link in order the payment to proceed. |

| currency | String | Currency of the transaction GBP |

| errorCode | Integer | Provides additional detail should an error have occurred with the transaction. |

| id | String | Unique transaction ID. This ID should be stored as it is required for later transaction actions. |

| invoiceId | String | Order/invoice/transaction/basket number generated by the host website, as passed in the request. |

| message | String | Message confirming the processing result of the request. |

| paymentMethod | String | Payment method ecospend |

| rrn | String | Unique reference allocated by Ecospend. |

| status | String | Ecospend payment status. |

| success | Boolean | Confirms whether the transaction has been successful. |

Example Request and Response

- Request

- Response

{

"bankId": "obie-coutts-sandbox",

"amount": 25,

"currency": "GBP",

"invoiceId": "1631161931",

"description": "Car Service",

"accountId": "uuid000001",

"email": "example@merchant.com",

"locale": "eng",

"terminalId": "z553ffcc-7df4-44b1-887b-la4108af9c94",

"paymentMethod": "ecospend",

"transactionType": "SALE",

"returnUrl": "https://test.com",

"callbackUrl": "https://test.com",

"failureCallbackUrl": "https://test.com",

"billingAddress": {

"firstName": "John",

"lastName": "Doe",

"streetAddress1": "Fulham Rd",

"postalCode": "SW6 1HS",

"city": "London",

"country": "GB"

}

}

{

"accountId": "uuid000001",

"amount": 25,

"authDateTimeUtc": "2021-09-09T04:32:26.381179864Z",

"bankUrl": "https://api.coutts.useinfinite.io/authorize?response_type=code%20id_token&client_id=CPtWqIqSCNqnGWNjnDzPG-9bnBVnvBUO3OKExwDBA8=&scope=openid%20payments&redirect_uri=https://redirect.ecospend.com/redirect/ TRUNCATED",

"currency": "GBP",

"errorCode": 0,

"id": "9de52ca0-19ed-4467-8cdc-2c11a715d7da",

"invoiceId": "1631161931484",

"message": "Order successfully created",

"paymentMethod": "ecospend",

"rrn": "0107108d-326d-49f4-8420-21abf8e2dc5c",

"status": "AwaitingAuthorization",

"success": true

}

Display Consent Page

You are required to display a consent page to the payer before redirecting them to their chosen bank's URL. Ecospend document the mandatory requirements here and they also provide a link to the OBIE Customer Experience Guidelines (OBIE CEG) which provide some best practice around this required step.

Once you have received the payer's consent, you can move on to redirecting them to the Payment Page.

Redirect to Payment Page

After a user consents to continue to their bank, you should redirect the payer to the bankUrl provided as a part of the createOrder Response.

After that, the process continues on between the payer and their online banking system. Despite slight differences between banks, in principle, the payer logs in to their bank's system, sees the payment details and then authorises or cancels the payment. They, of course, can abandon without completing the process.

After completing the authorization process at their bank, the payer will be redirected to Ecospend's redirect URL. In the meantime, Ecospend Gateway will retrieve the status of the payment from the bank. Then Ecospend will send the payer to us. Finally, we return the payer to your returnUrl and we will send a Callback response to your callbackUrl, as per the below specification:

Callback Response

It is us who will send this POST to your callbackUrl, so it is presented as a response. If this POST fails however, we will not be able to retry it and you should utilise our Transaction Management API to determine the outcome of the transaction.

You can do this in response to receiving the redirected payer, if you have not received the callback Response in a timely manner.

| callback POST | ||

|---|---|---|

| Field Name | Data Type | Description |

| signature | string | Signature generated for the callback. |

| id | string | Unique transaction ID. This ID should be stored as it is required for later transaction actions. |

| paymentMethod | string | Payment method ecospend |

| rrn | string | Unique reference allocated by Ecospend. |

| amount | decimal | Refund amount. |

| currency | string | Currency of the transaction GBP |

| invoiceId | string | Order/invoice/transaction/basket number generated by the host website, as passed in the request. |

| accountId | string | Unique reference for the store processing the transaction, as passed in the request. |

| authDateTimeUtc | string | Date and time of when the transaction was authorised with the acquirer. |

| errorCode | integer | Provides additional detail should an error have occurred with the transaction. |

| success | boolean | Confirms whether the transaction has been successful. |

| transactionState | string | The current state of the transaction. |

| status | string | Ecospend payment status |

Example Response

{

"signature": "yDlqMP0vM/grI/VCFwM/q5lMBwBDKTr/hTjPze0Ca3Y=",

"id": "374873d1-f69e-44bd-a637-5b5b28734021",

"paymentMethod": "ecospend",

"rrn": "5dc9e424-f878-4114-bc18-3b5e414ac41f",

"amount": 3,

"currency": "GBP",

"invoiceId": "1631891547494",

"accountId": "uuid000001",

"authDateTimeUtc": "2021-09-17T15:12:37.016969534Z",

"errorCode": 0,

"success": true,

"transactionState": "CHARGE",

"status": "Completed"

}