Features

Alternate Payment Methods (APM)

We are always looking for ways to enhance the eCommerce solutions offered; One such enhancement is the addition of APMs, giving merchants a greater range of ways to be paid and providing the consumer the choice to pay in the method that best suits them. Currently Checkout supports the processing of card payments, Google Pay™, and PayPal. The consumer is able to choose between the available payment methods either in the payment “Widget” or on the payment form depending on the integration option chosen.

Google Pay™

We support Google Pay automatically on our solutions. This will be enabled by default when your solution goes live. Please see our Google Pay page for more information.

Apple Pay

Apple Pay is supported automatically on our solutions, however for the moment works only when using a full page redirect. We are working on a fix to this, and will detail the steps needed to add Apple Pay to Lightbox iFrames shortly.

Klarna

We support Klarna Payments. You can learn more about this Alternate Payment Method here

Multiple Integration Methods

To provide as much flexibility as possible you can choose the payment flow that works best for you. We have developed these different options to allow the solution to fit as closely as possible to your requirements.

- Embedded Widget

- Direct

Address Verification (AVS) and Cardholder Security Code (CSC) Validation

Checkout allows the merchant to provide additional checks (other than the availability of funds) on the consumer to provide a greater level of security on the transaction. Two such examples of this are AVS & CSC validation; Where required, and the data is provided, the solution will validate the numeric elements of the consumers House Number and Post Code as well as the three digit (or four in the case of American Express cards) CSC.

The integration API allows the integrator to set multiple matrix values which inform Checkout which results of these checks should be accepted and which should be rejected. This puts the integrator in complete control with changes to acceptance criteria able to be made quickly and in way which can be amended to fit the consumer profile.

Non-UK Consumers

The AVS validation service is only available when processing transactions for consumers whose billing address is in the UK. As such Checkout has been designed to only pass the AVS data and use the values in both the avsHouseMatrix and avsPostCodeMatrix when this is the case. When a non-UK consumers transaction is processed the AVS data supplied in the request is not sent. The above is designed to ensure that valid payments are not rejected when a non-UK consumer processes a transaction. Checkout uses the accountCountry field to determine whether to supply the data apply the checks.

Tokenisation

As the Checkout solution processes transactions via our central platform, all card transactions are tokenised automatically using the consistent token. This means that the same card processed under the same merchant system (regardless of processing channel) will see the same token ID returned. This functionality is very useful for tracking the consumer spend across multiple channels as well as simplifying the path to a ‘card linked’ loyalty program.

As well as capturing the token ID registered during the transaction process, Checkout also supports the integrator performing a Token Registration request where the card is tokenised, but no financial transaction takes place. This service is useful when a card is being used for identification or when the consumer just wishes to add a card to their wallet.

Token Wallet

There are benefits in using our consistent tokenisation functionality for the consumer as well, with the Token Wallet allowing them to select from a list of previously used cards. This avoids the need for data which has already been provided being re-keyed, removing potential friction from the payment process.

Mail Order & Telephone Order (MOTO) Processing

In addition to supporting the processing of eCommerce transactions Checkout also supports merchants who wish to process transactions using card numbers obtained over the phone or via the post. In these scenarios the member of staff uses the solution to enter the card details provided.

Multiple Currency Support

Utilising the power of the our platform, Checkout allows merchants to process transactions to their UK acquirer in a multitude of currencies. The currencies available to the merchant will differ depending on the acquirer used - please contact us for additional information.

Charitable Donations - Pennies

Pennies is a charity registered with the Charity Commission of England and Wales. Pennies is encouraging and facilitating charitable giving through technology that makes it easier for everyone to donate to charity when paying for goods and services by card online, in shops or even by mobile phone, in an efficient and effective way. Independent of cause and channel Pennies is inclusive: payment technology providers, retailers and consumers together making a difference for many charities. Every penny counts. The pennies from micro-donations are powerful. Card purchases have overtaken cash transactions and internet buying is on the increase. Just a few extra pennies from each of these transactions would add up to millions of pounds for charity. More information can be found on Pennies website at www.pennies.org.uk. We are a committed supporter of Pennies and its core values. To show this support we have taken the step to include Pennies support by default in every solution that we produce. Unlike some other providers in the market. We make no charge for this module now or in the future.

Authorisation & Charge Separately

To support merchants who are receiving orders but may not be able to allocate and dispatch goods instantly Checkout allows the transaction to be completed in two phases. The first phase sees the completion of an authorisation only transaction where the consumers funds are reserved but not captured. Once the merchant can fulfil the goods the transaction can be sent for settlement using the extensive Transaction Management API.

Transaction Management API

The Transaction Management API has been developed to allow integrators to perform transaction actions after the consumer has completed their element of the transaction. The API allows the below functions to be completed.

- Retrieve a transaction - checking the status.

- Settle an authorised transaction - for example when goods can be shipped.

- Reverse an authorised transaction - when the order needs to be cancelled prior to shipping.

- Refund a transaction - allows the consumer to receive a refund without the need to supply card details again.

For more details see Transaction Management.

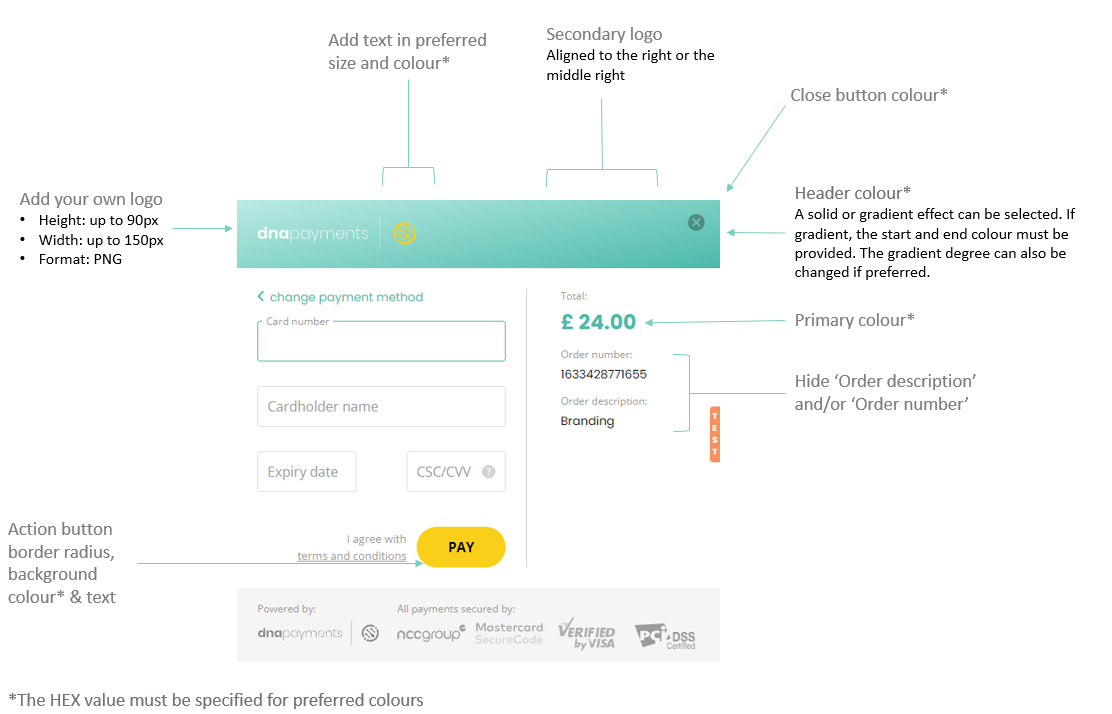

Customised Branding

Your rendered payment page or iFrame can be customised to match either a general brand, of even the whole look and feel of your site. This can be useful in providing consumer confidence especially when redirecting.

Please see the image below which details the customisation options available. You should discuss these with your Account Manager when setting up your first LIVE sites.